Buy a Texas CPA Certificate in 2025

Buy a Texas CPA Certificate online. How to make a Texas CPA Certificate online? Buy a fake CPA diploma in the USA. Becoming a Certified Public Accountant (CPA) in Texas requires meeting strict education, exam, and experience requirements. This certification is not only a symbol of professional competence in accounting, but also provides more opportunities for career development. Here are the key steps to obtaining a CPA certificate in Texas.

1. Meet the Education Requirements

The Texas State Board of Public Accountancy (TSBPA) requires applicants to complete 150 credits of college education, of which 30 credits must be in accounting and 24 credits in business-related courses. In addition, accounting courses must cover core content such as auditing, taxation, financial accounting, and management accounting. Many candidates choose to pursue a Master of Accounting (MAcc) after undergraduate studies or take additional courses to meet the credit requirements.

2. Pass the CPA Exam

The CPA exam consists of four parts:

Auditing and Attestation (AUD)

Financial Accounting and Reporting (FAR)

Regulation (REG)

Business Environment and Concepts (BEC) (will be changed to a new three-section structure after 2024)

Candidates must pass all four sections within 18 months, with a score of 75 or above in each section. Texas allows students to register for the exam after completing 120 credits, but must meet the 150 credit requirement before applying for a license.

3. Accumulate work experience, Buy a Texas CPA Certificate online.

Applicants must complete at least 1 year (2,000 hours) of accounting-related work experience under the supervision of a licensed CPA. The work must involve auditing, taxation, financial consulting or other accounting services, and the employer must provide proof.

4. Pass the ethics exam

Texas requires CPA applicants to pass the ethics exam of the AICPA (American Institute of Certified Public Accountants) to ensure that they have professional ethics.

5. Submit an application and pay fees

After completing the above steps, applicants must submit a formal application to TSBPA and pay the corresponding license fee. After the review is passed, you can obtain a Texas CPA license.

Summary

Obtaining a Texas CPA certificate requires long-term efforts, including completing higher education, passing difficult exams, accumulating work experience and complying with professional ethics. However, this certificate not only improves professional competitiveness, but also brings higher salaries and broader career development space. For those who are interested in pursuing a career in accounting, this is an important qualification that is worth investing in.

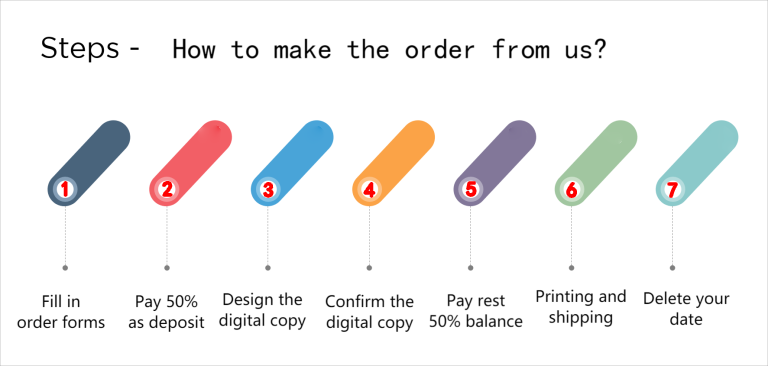

How to place an order

1.Fill in the form above

2.Pay 50% as a deposit

3.Design electronic drafts

4.Confirm content information

5.Pay the balance

6.Printing

7.Deliver to you by DHL and FedEx

8.Tell you the tracking number

Order Form Download

Download For Windows

Download For Mac OS X

express delivery