Buy Fake Diploma|Fake College Diploma|Fake University Diploma

We have all kinds of fake certificates as you can see on our website, like ACCA, AQA, CPA, CELTA, GCE, BTEC, CIPS, City&Guilds, PMP, NVQ, SQA, EMT, Medical,etc, certificates.

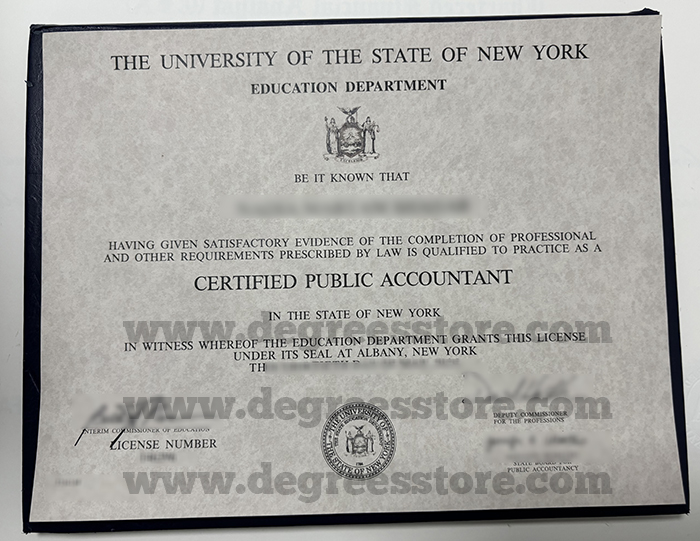

Buy a New York CPA certificate. Order a NY CPA License in 2025. To obtain a New York State (NY) CPA license, you must meet specific education, examination, and experience requirements set by the New York State Board of Public Accountancy (NBA). Here are the step-by-step instructions:

1. Education Requirements

Earn a bachelor’s degree or higher from an accredited institution.

150 semester hours (including specific accounting and business courses):

Accounting (33 credits) – must include:

Financial Accounting

Cost Accounting

Taxation

Auditing and Assurance

Business (36 credits) – includes the following courses:

Business Law

Finance

Economics

Information Technology

Note: New York State allows candidates to take the CPA exam with 120 credits, but 150 credits are required to obtain a license.

Where can I buy a NY CPA License?

2. Pass the Uniform CPA Examination

Apply through NASBA (National Association of State Boards of Accountancy).

Complete all 4 CPA exam sections within 18 months:

Auditing and Attestation (AUD)

Business Environment and Concepts (BEC) – to be replaced by a new discipline in 2024

Financial Accounting and Reporting (FAR)

Regulation (REG)

3. Experience Requirements

1 year (2,000 hours) of experience under the supervision of a CPA.

Experience must include:

Experience in accounting, auditing, tax, or financial advisory services.

Work in public accounting, industry, government, or academia.

4. Ethics Exam (Optional in New York State)

The AICPA Ethics Exam is not required in New York State, but is recommended for career advancement.

5. Apply for a New York State CPA License

Submit an application to the New York State Education Department (NYSED).

Pay the required fee.

Provide official transcripts, proof of experience, and CPA exam scores.

6. Continuing Professional Education (CPE)

After licensure, 40 hours of continuing professional education (CPE) are required each year (with specific ethics requirements).

Additional Notes

The New York State Education Department (NYSED) regulates CPA licensure in New York State (not NASBA).

Foreign Education: If you studied outside the United States, you may need to obtain an evaluation from NACES (e.g., through ECE or FACS).

How to place an order

1.Fill in the form above

2.Pay 50% as a deposit

3.Design electronic drafts

4.Confirm content information

5.Pay the balance

6.Printing

7.Deliver to you by DHL and FedEx

8.Tell you the tracking number

Order Form Download

Download For Windows

Download For Mac OS X

express delivery